CACE has advocated for issues related to school safety and to the way Pennsylvania funds its traditional public schools and charter schools. Our advocacy research includes:

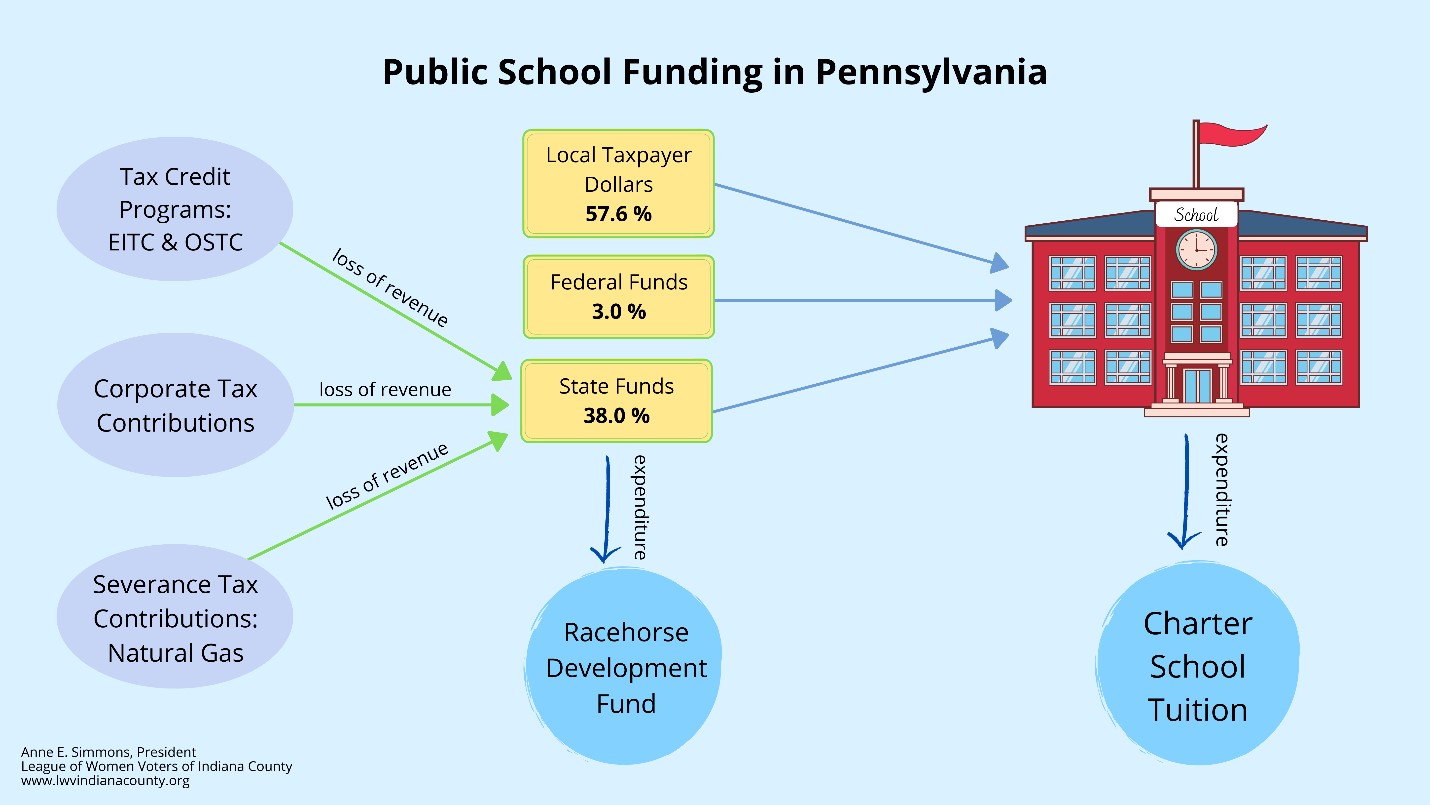

The state’s share of school funding comes out of the General Fund, a fund built up through state tax revenues. In PA the greater share of school funding comes from local taxes. A small portion comes from the federal government.

The yellow boxes show the percentage of funding that comes from local taxes, the federal government, and the state. Those state funds come out of the General Fund. And when the legislature makes too many concessions to special interests, the General Fund loses revenues and shrinks.

We are currently losing revenue health to tax credit programs, corporate tax reductions, the absence of a natural gas severance tax, and the payout from the General Fund to the Racehorse Development Fund. Our common interests, such as education, lose funding. In fact, Pennsylvania is ranked 44th among all states in the percent of funding it contributes to school district budgets (38%).

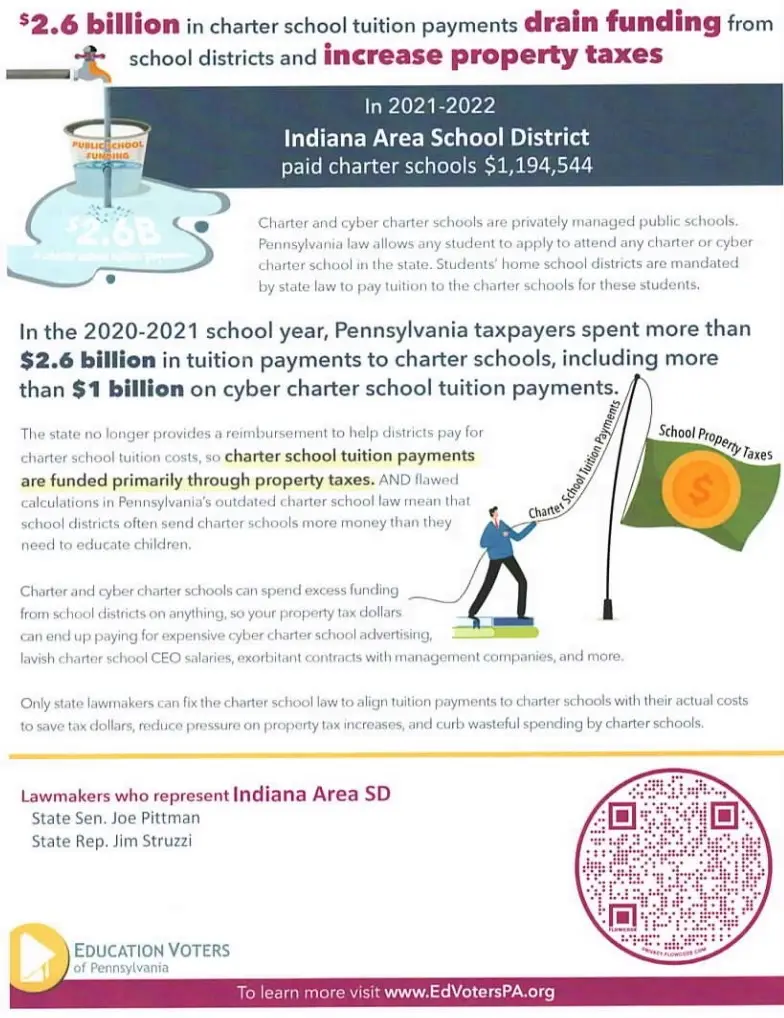

Another drain on the adequacy of school district budgets is represented by each district’s payment of charter school tuitions for district students who attend a charter school. Charter tuition rates are often higher than the cost of educating a student in the traditional public school. It has been known for 20 years that the charters are egregiously overpayed for special education student tuitions. The inflated tuitions drain a home district budget already constrained by other revenue losses to the state’s General Fund.

Losses due to PA Education Tax Credit Programs

CACE recommends a close look at PA’s education independence tax credit program (EITC) and scholarship tax credit program (STC). These siphon millions of dollars from the general fund, out of which our public school districts are funded.

Losses due to the Racehorse Development Fund

Learn More at www.kidsoverhorseracing.org

Losses due to Corporate Tax Rates

Learn More at www.krc-pbpc.org

Losses due to Natural Gas Severance policy

Learn More at www.krc-pbpc.org

Once a school district has its budget for the year, another source of revenue loss occurs at the district level when each district must pay the tuition of any student in the district who is attending a charter school. Those tuitions are almost always higher than what it would cost to educate that student in the home district. This is particularly the case for cyber charter school tuitions, and for special education tuitions in both the cyber and brick and mortar charter schools.

Charter school law reform is crucial to addressing the inequitable funding formulas that were set in motion back in 1997. The original charter law has governed not only tuition rates, but learning outcomes reporting, evaluation, and administrative and financial transparency.

The first resource below is the second of four Auditor General reports that recommended specific ways to amend charter law. The first report (2010) concluded that the “disparate charter school funding mechanizations cost PA taxpayers approximately $936 million during the 2008-09 school year” alone. We can now multiply that by 12 for a conservative estimate of losses due to charter tuition overpayments between 2008 and 2020.

The 2014 PA Auditor General Report, “Pennsylvania Charter School Accountability and Transparency: Time for a Tune-Up,” recommends specific funding, administrative, and legal reforms. It also begins to chart the expenditures that are flowing out of the school districts to pay cyber charter tuitions. Please see page 15 in this report to hear the concerns of low wealth and rural districts as they lose precious funding (including local tax money) to the inflated tuitions of cyber charter programs.

Provides research on current effects and possible solutions for inequities

in the PA charter school funding formulas.

To avoid heavy local school tax burdens for those low wealth communities least able to carry that burden, CACE has advocated for a progressive rather than a regressive tax structure. Here are a few resources important to that advocacy.

Fair Share Tax Plan The General Assembly of Pennsylvania Senate Bill No. 555 Session of 2017

Fair Share Tax Plan to Support Public Investment in Pennsylvania from the Pennsylvania Budget and Policy Center

The Price of Property Tax Elimination from the Keystone Research Center

A pending lawsuit, William Penn School District et al. v. PA Department of Education et al., argues that the school funding system in PA often disadvantages low wealth school districts, whether urban, rural, or suburban.

In low wealth communities, the state’s share of school funding and the local taxpayers’ share never add up to enough to fund equitable learning opportunities. You can read about this important lawsuit, due to be heard in PA Commonwealth Court during 2021.

Learn about the lawsuit, William Penn School District et al. v. PA Department of Education et al., which argues that PA’s school funding system is unconstitutional: neither adequate nor equitable. At this Education Law Center site you will find FAQs and case documents.

Learn more at http://fundourschoolspa.org

The Education Law Center PA and the Public Interest Law Center explain the grounds for the lawsuit in these Powerpoints:

Learn More at PPT-April-12-Briefing-for-Web.pdf (pubintlaw.org)

Learn More at Education-Justice-Report-1.pdf (elc-pa.org)

During 2018-2019 CACE studied and publicized the PA school safety mandates that affected not only school buildings and grounds, but the administrators, faculty, staff and students of the schools as well as some community and municipal service providers.

CACE visited three regional school districts: Apollo-Ridge School District, Penns Manor School District, and Indiana Area School District. We learned about how those districts were meeting the mandates, and we began to understand the particular need for more social and emotional learning supports.

The resources below show the work involved in meeting the mandates of PA Act 44, and each school’s ultimate concern with student safety—safety seen as not only physical, but also social and mental.

PA Act 44 of 2018 mandated many safety practices, protocols and trainings. The following resource describes what school districts had to do to meet the mandates of PA Act 44. The link opens a Powerpoint presentation titled “Act 44 of 2018: Key Information for School Entities.” It covers all of the many school safety mandates in Pennsylvania’s Act 44.

By mid-January 2019, the “Safe2Say” program had been implemented in all Pennsylvania public school districts, as mandated by Act 44 of 2018. Learn about the Safe2Say Program at the Sandy Hook Promise site.

The annual reports on the Safe2Say Program show a need for increasing school-based mental health resources. Here are the reports and an August 2020 press release:

The Safe2Say Something reports showed an increased need in PA for in-school providers of psychological, counseling, social work, and nursing services. PA Senate Bill 749 seeks to provide for adequate numbers of certified professionals to meet students’ increasing social, emotional and physical health needs. It also would cap the workload of those professionals. CACE supports SB 749. SB 749 is pending as of Jan. 2021. To read the text of this bill please visit:

PA’s 2018 School Safety Task Force called for improved security, more mental health services and community connections.

For more information on PA School District Data, go to PA Schools Work

The LWVIC voted to support the school funding lawsuit seeking court oversight of adequate and equitable funding. Read the resolution here.

Learn more at School Funding Lawsuit and FundOurSchoolsPA

Read the November 18, 2021 Indiana Gazette Opinion piece written by the LWVIC Child Advocacy Committee on Education entitled “On Trial: Fair & Adequate Funding For All PA Children”

The League shared information on voting and democracy and gave children the opportunity to learn about voting with a “special election” for their favorite pet.

Click here to watch part I about the league!

The League of Women Voters, a nonpartisan political organization, encourages informed and active participation in government, works to increase understanding of major public policy issues, and influences public policy through education and advocacy.